What Is The New Theranos? Spotting The Next Big Startup Deception

The ghost of Theranos, you know, still seems to hang over the world of innovative companies. It truly makes people wonder, what is the new Theranos? After all, the story of a company that promised so much, yet delivered so little, really left a lasting mark on how we view ambitious startups. People are, quite frankly, a bit more cautious now.

It's a question that, quite honestly, keeps many investors, journalists, and even the general public a little on edge. We all want to believe in big ideas, don't we? We like your stories of breakthroughs and world-changing technology. But the sting of past deceptions makes us ask, where might the next one appear? So, figuring out how to spot a similar situation, that's really important for everyone.

This article, you see, will help you pick out the signs. We'll look at the patterns, the behaviors, and the very, very big promises that should make you pause. We want to help you understand what to watch for, so you can be more informed about the companies that claim to be the next big thing. Basically, it's about learning from what happened before.

Table of Contents

- Unmasking the Next Theranos

- The Theranos Shadow: What We Learned

- Red Flags to Watch For

- Lessons from the Past for the Future

- How Investors and the Public Can Protect Themselves

- Frequently Asked Questions

- Moving Forward with Caution

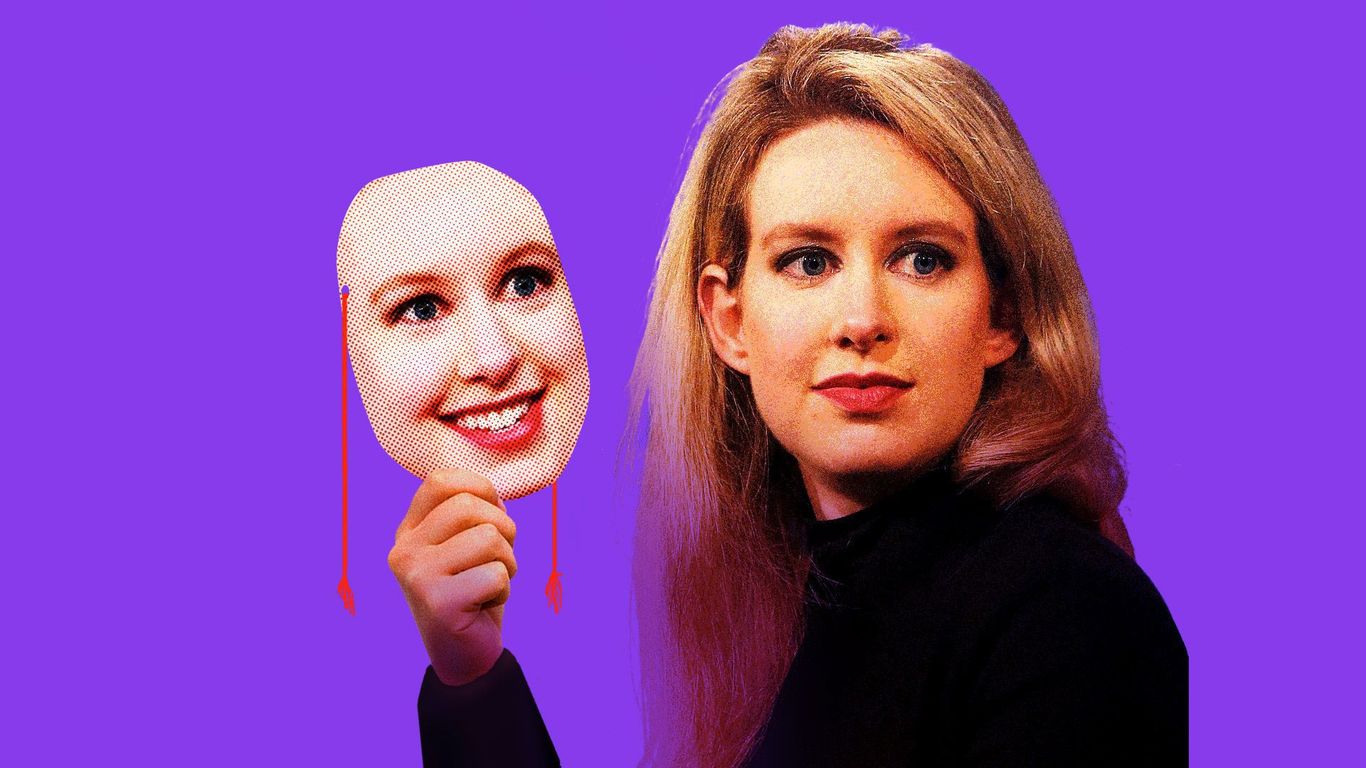

Unmasking the Next Theranos

The search for what is the new Theranos, you know, is really about looking for any company that might be building on smoke and mirrors. People are more aware now, and that's a good thing. We are all, in a way, keeping an eye out for those too-good-to-be-true stories. The public's perception, you see, has changed quite a bit since the Theranos saga unfolded. This change, it's almost like "the new keyword changes the context under which the function is being run," where the "function" is how we evaluate startups. The way we look at things has simply shifted.

It's not just about medical tech anymore, either. This kind of deception, it could show up in any field. We might see it in artificial intelligence, in green energy, or even in space exploration. Anywhere, really, that promises a huge leap forward without clear, verifiable steps. The question "what is the new Theranos?" means we're looking for that same pattern of over-the-top claims and a lack of real evidence. We are, basically, much more skeptical now about grand visions that lack solid foundations.

People are talking more about these things, too. There are, you know, more discussions online, more articles asking tough questions. It's not like before, when hype could just carry a company for years. Now, there's a collective effort to share information and poke holes in stories that seem a little too perfect. This shared knowledge, it's pretty important, actually, for keeping everyone honest. We're all trying to figure out how to spot the fakes before they cause a lot of trouble.

The Theranos Shadow: What We Learned

Theranos, you know, was a blood-testing company that promised to run many tests from just a few drops of blood. It sounded amazing, absolutely revolutionary. But, as we all found out, the technology just wasn't there. The company, it turns out, was using standard machines for most of its tests, and its own special device simply didn't work as advertised. This whole situation, it really showed us the dangers of unchecked ambition, and frankly, outright deception. It taught us a very hard lesson about trusting without verifying.

The biggest takeaway, you see, was that big promises need big proof. It's not enough to just say you have something incredible. You have to show it, and it needs to stand up to scrutiny from independent experts. The story also highlighted how powerful a charismatic leader can be, and how that can sometimes blind people to serious problems. It was, in some respects, a masterclass in how not to build a company, or, really, how not to conduct business with integrity. We learned that the "new and delete keywords are actually some defined c operators" in a business sense, too, meaning how companies are created and, sadly, how they can be undone.

We also learned about the role of the media and investors. They, you know, can get swept up in the excitement. The Theranos story was often told as a triumph of innovation before it was truly proven. This lack of critical questioning, especially early on, allowed the deception to grow. It really shows how important it is for everyone involved to ask tough questions, even when a story seems incredibly inspiring. That, is that, a crucial lesson for anyone looking at new ventures today.

Red Flags to Watch For

So, how do we spot the next one? There are, you know, some clear signs that should make you raise an eyebrow. These are not always definitive proof of fraud, but they are certainly reasons to dig a lot deeper. It's like, you know, a little alarm bell should go off in your head. Paying attention to these signals can really save you a lot of trouble, honestly. You want to be careful, after all.

Unproven Technology

If a company claims to have a breakthrough technology that seems to defy current scientific understanding, and they can't show independent, peer-reviewed data, that's a huge red flag. They might say, "New(t) allocates zeroed storage for a new item of type t and returns its address, a value of type *t," suggesting they're starting fresh with something completely new. But starting fresh with an idea is different from having a working product. You need to see actual results, not just promises of future potential. Where are the studies? Where are the independent validations? These are important questions, basically.

Often, these companies will talk in very vague terms about how their technology works. They'll use buzzwords but avoid specifics. If you ask a detailed question, you might get a lot of hand-waving or a claim that it's "proprietary" and can't be shared. While some secrecy is normal in business, total secrecy around core claims is not. It's like, you know, if someone tells you they have a magic box but won't let you look inside, you should probably be a bit suspicious. That's just common sense, really.

Secretive Operations

Companies that operate in extreme secrecy, especially regarding their core product or service, often have something to hide. Theranos, for instance, kept its labs under wraps and refused to let outside experts examine its technology. If a company avoids external audits, refuses to publish data, or restricts access to its facilities for legitimate reviewers, that's a big warning sign. It's almost as if "if new and delete are not defined in a class, these may" imply a lack of fundamental structure or accountability within the company's operations. They are, in a way, trying to avoid the very mechanisms that ensure transparency.

They might also have very few employees who truly understand the core technology, or they might isolate those who do. This creates a situation where only a very small circle knows the real truth, making it easier to control the narrative. You know, when a company seems to be built on a need-to-know basis, and very few people seem to "know," that's a problem. It really goes against the idea of open innovation and collaboration, which is typically how real progress happens. So, be wary of excessive secrecy, definitely.

Cult of Personality

When a company's success seems to rest almost entirely on the charisma and vision of a single founder, that's a yellow flag. These founders are often brilliant at storytelling and inspiring confidence, but their personal charm can overshadow a lack of substance in the product itself. "When you don't use the new keyword, the context under which function vehicle()." This phrase, in a way, speaks to how the founder's personal context can dominate, rather than the company's actual performance. It's like the individual becomes more important than the actual work being done. This can be very, very misleading.

Such leaders might surround themselves with loyalists who don't challenge them, or they might dismiss critics as simply not understanding their "vision." They often have an almost messianic belief in their own ideas, which can be infectious but also dangerous. You know, it's great to have a passionate leader, but passion needs to be backed by facts and results. If the leader is the only thing holding the whole thing together, that's a bit shaky, isn't it? It's important to look beyond the person and at the actual business.

Aggressive PR and Lack of Scrutiny

A company that spends a huge amount on public relations, getting glowing profiles in major media outlets, but seems to avoid any real, tough questions from independent journalists or scientists, should make you pause. They're very good at "advertising reach devs & technologists worldwide about your product, service or," getting their message out there. But what about the critical follow-up? Are they avoiding interviews where they might be challenged? Are they only talking to friendly reporters? This is a pretty common tactic, actually.

Real innovation can speak for itself, eventually. While PR is a part of business, an overreliance on it, especially when coupled with a lack of transparency, is concerning. If the media narrative seems too perfect, without any bumps or critical analysis, it's worth asking why. You know, good journalism often involves asking uncomfortable questions. If those questions aren't being asked, or answered, that's a problem. It really suggests that they are controlling the narrative very tightly.

Rapid Valuation Without Revenue

A company that achieves an incredibly high valuation very quickly, based almost entirely on future potential rather than actual sales or proven market adoption, needs careful examination. They might claim, "It returns a pointer to a newly allocated zero value of type t, ready for use," meaning they are ready to go. But "ready for use" doesn't mean "already used successfully." If they're valued at billions but have little to no real revenue, or their revenue comes from unusual sources, that's a major red flag. Money has to come from somewhere real, after all.

Investors can get caught up in the fear of missing out, pushing valuations higher and higher based on hype. But a business needs to make money, eventually. If the path to revenue is unclear, or constantly shifting, then the high valuation is just a house of cards. You know, it's like building a very tall tower without a strong foundation. It looks impressive for a while, but it's bound to fall. That's just how it works, pretty much, in the business world.

Lessons from the Past for the Future

The biggest lesson, you know, is to always be skeptical. Don't let the excitement of a new idea blind you to the need for solid evidence. Ask hard questions, and don't be satisfied with vague answers. This applies to everyone: investors, journalists, and even potential customers. We should, in a way, use the experience of Theranos to make us all a bit wiser. It's about learning to trust your gut feeling when something seems off, and then acting on it. That's, you know, a pretty important skill to have.

We also learned the value of independent verification. Relying on internal reports or testimonials from people with a vested interest is not enough. You need outside experts, people with no stake in the company's success, to confirm its claims. This is where, you know, shared knowledge becomes so powerful. "Stack overflow for teams where developers & technologists share private knowledge with coworkers," that kind of collaborative spirit for sharing verifiable facts, is what we need more of in evaluating new ventures. It helps to have many eyes on a problem, truly.

The Theranos story also highlighted the importance of governance and oversight. Strong boards of directors, ethical leadership, and clear accountability structures are vital. Without them, even well-intentioned companies can drift into dangerous territory. It's like, you know, having "shared pointers will do book keeping of delete automatically" in a system; you need mechanisms that automatically handle problems and ensure things are cleaned up properly. This kind of built-in accountability is crucial for preventing future issues, absolutely.

How Investors and the Public Can Protect Themselves

For investors, due diligence is everything. Don't just rely on what the company tells you. Talk to former employees, industry experts, and even competitors. Look for independent audits of their financials and their technology. If a company resists this kind of scrutiny, that's a very clear sign to walk away. It's about, you know, really doing your homework before you put your money down. You wouldn't buy a house without an inspection, would you? So, treat your investments with the same care, pretty much.

For the public, it's about critical media consumption. Don't just read the headlines or the positive profiles. Look for investigative journalism, for articles that ask difficult questions. If something sounds too good to be true, it very often is. You know, "This command has a default alias set to ni but if you're used to unix commands you can create" new ways to investigate. That means using all the tools at your disposal to dig deeper. Always seek out multiple sources of information, especially from those who might be critical. Learn more about spotting red flags on our site, and link to this page here for more detailed guidance.

And for everyone, sharing information responsibly is key. If you see something concerning, speak up. If you have knowledge that can help others avoid a bad situation, share it. The collective wisdom of many people is much stronger than any single person's ability to be fooled. It's about building a community of informed citizens and investors who can, you know, help each other avoid these kinds of pitfalls. You can always check reputable sources like The Wall Street Journal's reporting on Theranos for a good example of how investigative journalism can uncover the truth.

Frequently Asked Questions

What made Theranos a fraud?

Theranos was a fraud because it claimed to have technology that could perform many blood tests with just a few drops of blood, but this technology simply did not work. The company misled investors, doctors, and patients about its capabilities, using traditional machines for most tests while pretending its proprietary device was functional. This deception was, you know, at the very heart of the problem.

Are there companies like Theranos today?

While no company has precisely mirrored Theranos's story, the patterns of over-promising, extreme secrecy, and unproven technology can appear in various startups across different industries. The question "what is the new Theranos?" is really about identifying these common red flags in today's market. You have to, you know, be vigilant and look for similar warning signs, because they can show up anywhere, honestly.

How can I avoid investing in a fraudulent startup?

To avoid investing in a fraudulent startup, you should conduct thorough due diligence. This means independently verifying all claims

Theranos unveils new desktop blood test device instead of data on its existing technology

What jumped out from new Theranos documentary "The Inventor"

Theranos Founder Faces a Test of Technology, and Reputation - The New York Times