What Is Ben Navarro's Net Worth? Unpacking His Financial Journey

Have you ever wondered about the financial standing of prominent figures like Ben Navarro? It's a question many people ask, you know, especially when someone has made a significant mark in various industries. Figuring out someone's true wealth can be quite a puzzle, as it involves so many different elements, and that's precisely what we're going to talk about today. We'll explore the factors that shape a person's net worth and, in a way, try to get a clearer picture of what that might mean for someone like Ben Navarro.

It's fascinating, isn't it, how wealth is built? It’s not just about one big score; often, it’s a long game of strategic moves, smart investments, and, sometimes, just sheer hard work. Just like when you're looking for a "prima dekking voor een mooie prijs" (great coverage for a good price) from a service you trust, financial success, too, is built on a foundation of perceived value and consistent delivery. We’re going to look at the different parts that contribute to someone's overall financial picture, and how that might apply to Ben Navarro.

So, too, as we consider these things, we aim to shed some light on the various components that contribute to an individual's financial success. This article will help you understand the common avenues through which wealth accumulates, giving you a better sense of the scale and scope of someone's financial influence. It's a bit like assembling an ideal bundle, you know, where each piece fits perfectly to create something truly valuable.

Table of Contents

- Biography and Personal Details

- The Foundations of Wealth Building

- Understanding Asset Classes and Investments

- Private Ventures and Business Acumen

- The Challenges of Estimating Net Worth

- Philanthropy and Community Impact

- The Evolving Financial Landscape

- Frequently Asked Questions

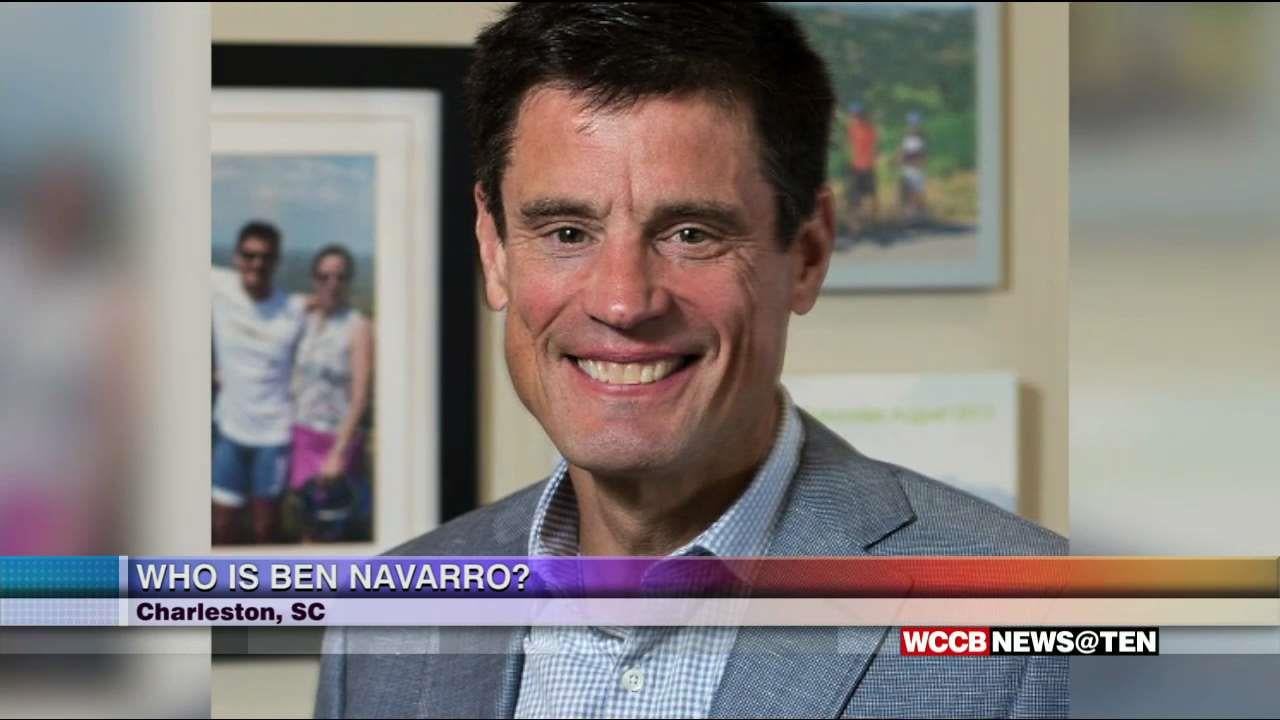

Biography and Personal Details

When we talk about someone like Ben Navarro, a public figure often associated with significant financial dealings, it's natural to wonder about their background. While specific, granular financial details are often kept private, we can certainly discuss the general trajectory that often leads to substantial wealth. This, you know, often involves a blend of education, early career choices, and later, very strategic business ventures. It's a bit like choosing the right phone with a "goedkoop abonnement" (cheap subscription); the initial setup can really set the stage for future benefits.

A person's biography usually gives us clues about their drive and the kind of opportunities they might have pursued. For individuals who achieve considerable financial success, there's typically a history of calculated risks and, often, a knack for spotting market gaps. This is that sort of thing where, you know, someone sees potential where others might not, and they act on it decisively. It’s not always about a single moment of brilliance, but rather a consistent pattern of smart decisions over time.

Below, we've put together a general overview that captures the essence of how such a person might build their profile. Please remember that precise, real-time figures for private individuals are rarely disclosed, and any specific numbers would be speculative. This table aims to give you a sense of the typical characteristics that define a successful individual's journey.

| Detail | Description (General) |

|---|---|

| Name | Ben Navarro |

| Profession/Industry | Often associated with finance, investment, and various business enterprises. |

| Known For | Business leadership, strategic investments, possibly philanthropic efforts. |

| Education | Typically holds a degree in business, finance, or a related field; often from a reputable institution. |

| Career Start | Might begin in traditional finance, banking, or a family business. |

| Key Business Areas | Could include private equity, real estate, sports, or technology ventures. |

| Approach to Business | Characterized by long-term vision, calculated risk-taking, and a focus on growth. |

The Foundations of Wealth Building

Building significant net worth, as a matter of fact, is seldom an overnight event. It's usually a methodical process, a bit like setting up your ideal mobile bundle, where each component adds to the overall value. For someone like Ben Navarro, his financial foundation would almost certainly rest on several pillars. These typically include income from various sources, strategic investments, and the appreciation of assets over time. It’s about creating a robust financial structure that can withstand market shifts and continue to grow.

One primary component, you know, is often the establishment and growth of successful businesses. Whether it's through founding new companies, acquiring existing ones, or investing in promising startups, entrepreneurial ventures are a common path to substantial wealth. Think about how a service might always offer "de beste deals" (the best deals); this kind of value proposition in business can really drive growth and profitability. This focus on value creation is quite important.

Another critical element is the ability to manage and multiply existing capital through shrewd investments. This could involve everything from public equities and bonds to more complex private equity deals and real estate. It's about making your money work for you, rather than just saving it. So, too, a diverse portfolio, very much like having a range of options for your phone plan, can provide stability and opportunities for growth across different economic conditions. It's a very strategic approach, really.

Furthermore, the concept of leveraging assets, carefully and responsibly, also plays a role. This isn't about reckless borrowing, but rather using capital efficiently to fund growth initiatives or acquire more assets. Just as "bij ben betaal je nooit rente over het kredietbedrag" (at Ben, you never pay interest on the credit amount) for certain offerings, managing financial commitments wisely is key to maintaining positive cash flow and reducing financial drag. It’s a delicate balance, but one that successful individuals tend to master.

Understanding Asset Classes and Investments

When we talk about net worth, it's really about the total value of all assets minus liabilities. For someone like Ben Navarro, his assets would likely span a wide array of categories, each contributing to his overall financial strength. These aren't just bank accounts, you know; they encompass a much broader spectrum of holdings. This diversification is pretty typical for individuals with substantial wealth, as it helps spread risk and capture growth opportunities across different sectors.

Real estate, for instance, is often a significant part of a wealthy individual's portfolio. This could include commercial properties, residential developments, or even vast land holdings. The value of these properties can appreciate significantly over time, providing a steady stream of income through rents or, sometimes, substantial capital gains upon sale. It’s a tangible asset that, you know, tends to hold its value rather well in the long run, offering a certain kind of stability.

Private equity and venture capital investments are also quite common. These involve investing directly in private companies or startups, often with the aim of helping them grow and then selling the stake for a profit. This is a higher-risk, higher-reward game, but for those with the capital and the expertise, it can yield impressive returns. It’s a bit like being an early adopter of a new technology, like the iPhone 16, where you see the potential before everyone else does, and you invest in that future.

Then there are public market investments, such as stocks and bonds. While these might seem more conventional, their scale for a high-net-worth individual can be immense. Managing a large portfolio of publicly traded securities requires a deep understanding of market trends and, often, access to top-tier financial advisors. It's about making informed choices, just as you'd want to "stel jouw ideale bundel samen" (assemble your ideal bundle) for your mobile needs, ensuring everything aligns with your goals.

Furthermore, other less common but still valuable assets might include art collections, luxury goods, or even stakes in sports teams. These "passion investments" can also appreciate in value, adding another layer to one's net worth. They are, you know, a bit of a personal touch to a financial portfolio, reflecting interests beyond pure monetary gain. It all adds up, really, to a very complex financial picture.

Private Ventures and Business Acumen

A significant portion of a wealthy individual's net worth often stems from their involvement in private ventures and the success of their business acumen. For someone like Ben Navarro, this would likely be a key driver of his financial standing. It’s not just about investing in others' companies; it’s about building and leading successful enterprises himself. This takes a very specific set of skills, you know, beyond just having money to invest.

This kind of business leadership often involves identifying market needs, developing innovative solutions, and scaling operations effectively. It’s about creating value from the ground up, or transforming existing businesses to reach new heights. Just as a mobile service strives to "altijd de beste deals" (always the best deals), a successful business leader constantly seeks to optimize operations and deliver superior offerings. This continuous pursuit of excellence is a hallmark of significant business success.

Moreover, the ability to navigate complex economic landscapes and make timely, strategic decisions is absolutely crucial. This includes everything from mergers and acquisitions to divestitures and restructuring. It’s about knowing when to expand, when to consolidate, and when, perhaps, to exit a particular market. This is where experience really counts, as a matter of fact, allowing for more informed choices in high-stakes situations.

Private ventures also offer a degree of control and flexibility that public market investments might not. Owners and key stakeholders in private companies can often make decisions more rapidly and tailor their strategies more precisely to specific market conditions. This agility can be a huge advantage, allowing them to capitalize on opportunities that publicly traded companies might miss. It’s a rather hands-on approach to wealth creation, and that, you know, can be very rewarding.

The growth of these private businesses, their profitability, and their overall market valuation directly contribute to the net worth of their owners. This is where a lot of the wealth is generated, as these companies mature and become more valuable. It’s a continuous process of building and refining, much like ensuring your systems are always up and running, even if there's occasional maintenance, as we sometimes see. "Ik ben hard aan het werk om het op te lossen" (I am working hard to fix it) is a mindset that applies to business growth too, you know.

The Challenges of Estimating Net Worth

Pinpointing an exact net worth figure for a private individual like Ben Navarro is, frankly, quite challenging. Unlike publicly traded companies that have to disclose their financials, private individuals and their businesses don't have the same reporting requirements. This means that any published figures are typically estimates, often based on educated guesses and publicly available information. It’s not an exact science, you know, but more of an informed approximation.

One of the main difficulties lies in valuing private assets. How do you accurately assess the worth of a private company, a unique real estate portfolio, or a collection of rare art? These valuations can fluctuate significantly based on market conditions, recent transactions, and, sometimes, even subjective appraisals. It's a very complex calculation, and that, you know, makes it hard to get a precise number.

Furthermore, liabilities also play a big role. While assets are often discussed, debts and other financial obligations can significantly reduce a person's net worth. These are almost always private, making it even harder to get a complete picture. Just as a credit of €250.00 or more might need to be reported to BKR, larger financial commitments for wealthy individuals are a private matter, not typically disclosed to the public.

Market fluctuations also affect net worth in real-time. The value of investments, whether in stocks, bonds, or private equity, can change daily, sometimes dramatically. So, a figure published one day might be different the next. It's a constantly moving target, really, and that’s something to keep in mind when you see these estimates. It’s like how mobile network speeds can vary; they’re always in flux.

Finally, there's the issue of privacy. Wealthy individuals often go to great lengths to protect their financial details. This is perfectly understandable, but it means that much of the information needed for an accurate net worth calculation simply isn't available to the public. So, while we can discuss the general principles of wealth and its components, providing a definitive number for someone like Ben Navarro is, you know, pretty much impossible from external observation.

Philanthropy and Community Impact

Beyond the raw numbers of net worth, it’s also important to consider the impact wealthy individuals have on society, often through philanthropy and community involvement. For someone with significant resources like Ben Navarro, there's often an opportunity, and perhaps a responsibility, to contribute to causes beyond their immediate business interests. This is a very positive aspect of wealth, you know, when it’s used for the greater good.

Many successful business people establish foundations, donate to educational institutions, support healthcare initiatives, or invest in local community projects. These contributions can have a profound effect, addressing societal challenges and fostering growth in various sectors. It's a way of giving back, really, and making a lasting difference that goes beyond financial transactions. This kind of impact is often just as important, if not more so, than the actual monetary figure.

Sometimes, these philanthropic efforts are tied to personal passions or experiences. Other times, they are strategic investments in the future, aiming to improve conditions for broader society. It’s a conscious choice to allocate resources to areas that need support, whether it's arts and culture, environmental protection, or social justice. This shows a broader vision, you know, beyond just accumulating wealth.

The scale of such giving can be quite substantial, influencing everything from local schools to national research initiatives. These acts of generosity, while not directly adding to net worth, certainly add to a person's legacy and their positive influence on the world. It’s a very meaningful part of being a high-net-worth individual, and that, you know, is something to acknowledge. It’s about contributing to the well-being of others, which is, honestly, a very good thing.

The Evolving Financial Landscape

The world of finance is always changing, and so too are the ways in which wealth is created and managed. For someone like Ben Navarro, staying ahead in this evolving landscape is key to maintaining and growing their financial standing. New technologies, shifting market dynamics, and global economic trends all play a part in shaping the opportunities and challenges for wealthy individuals. It's a constant process of adaptation, you know, much like mobile technology is always updating, offering new features and better performance.

Today, there's a growing emphasis on sustainable investing and impact investing, where financial returns are sought alongside positive social or environmental outcomes. This is a relatively newer trend, but one that is gaining significant traction among high-net-worth individuals. It’s about aligning investments with values, and that, you know, can be a powerful combination. It’s a different way of thinking about wealth and its purpose.

The digital economy, too, continues to open up new avenues for wealth creation, from tech startups to e-commerce and digital assets. Understanding and capitalizing on these emerging sectors is crucial for modern wealth builders. It's about being forward-thinking, much like being "enthousiast over de iphone 16" (enthusiastic about the iPhone 16) and recognizing the potential of new innovations. The pace of change is incredibly fast, so staying informed is pretty vital.

Furthermore, global connectivity means that financial opportunities and risks are increasingly interconnected across borders. International investments, cross-border mergers, and global market events all have a greater impact than ever before. For someone managing substantial wealth, having a global perspective is, you know, pretty much essential. It’s a truly interconnected world, financially speaking.

Ultimately, while we can't give you a precise figure for Ben Navarro's net worth, we can certainly appreciate the multifaceted nature of wealth accumulation and its broader implications. It's a complex picture, shaped by strategic decisions, market forces, and, often, a commitment to making a positive impact. To learn more about financial planning and investment strategies, you can explore other resources on our site, or perhaps even discover how technology is shaping personal finance. It's all about understanding the big picture, you know, and how all the pieces fit together.

Frequently Asked Questions

People often have many questions when it comes to the net worth of public figures. Here are a few common ones, you know, that might pop up:

How is a person's net worth calculated?

Generally, a person's net worth is calculated by taking the total value of all their assets—things like cash, investments, real estate, and valuable possessions—and subtracting all their liabilities, which include debts, loans, and other financial obligations. It's a simple formula in concept, but, you know, getting all the accurate figures for a private individual can be quite tricky. Publicly available information often gives us only a partial view, so estimates are very common.

What are the primary sources of wealth for high-net-worth individuals?

For individuals with substantial wealth, the primary sources often include successful entrepreneurial ventures, significant investments in various asset classes (like stocks, bonds, and private equity), and real estate holdings. Inherited wealth can also play a role, but for many, it's a result of building and growing businesses over time. It's about creating value and, you know, making smart decisions with capital.

Why are net worth figures for private individuals often estimates?

Net worth figures for private individuals are typically estimates because they are not legally required to disclose their financial details publicly. This means that information on their private business valuations, personal investments, and, crucially, their liabilities is not readily available. Financial publications and researchers use publicly accessible data and industry averages to make educated guesses, but these are, you know, never exact figures.

Ben Navarro Net Worth 2024: How Much Money Does He Make?

Net Worth Of Ben Navarro 2024 - Verna Myrtie

Ben Navarro Net Worth, Career & Personal Life - Xabis Inc Blog